PDF) Geometric Average Asian Option Pricing with Paying Dividend Yield under Non-Extensive Statistical Mechanics for Time-Varying Model

Numerical pricing of geometric asian options with barriers - Aimi - 2018 - Mathematical Methods in the Applied Sciences - Wiley Online Library

PDF) An exact and explicit formula for pricing Asian options with regime switching | Song-ping Zhu - Academia.edu

A robust numerical solution to a time-fractional Black–Scholes equation | Advances in Continuous and Discrete Models | Full Text

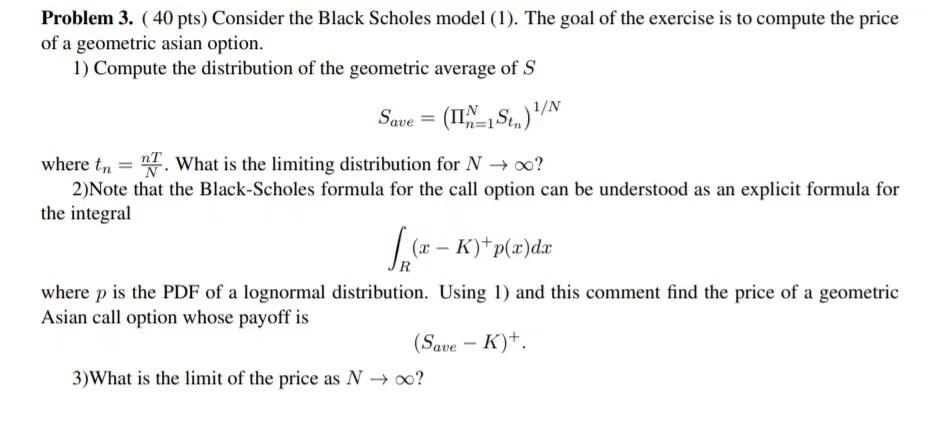

black scholes - Closed-form equation for geometric asian call option - Quantitative Finance Stack Exchange

Asian Option Pricing in Excel using QuantLib: Monte Carlo, Finite Differences, Analytic models for Arithmetic and Geometric Average. Example with live EUR/USD rate - Resources

Geometric Asian Options Pricing under the Double Heston Stochastic Volatility Model with Stochastic Interest Rate

Geometric Asian Options Pricing under the Double Heston Stochastic Volatility Model with Stochastic Interest Rate

Pricing and hedging of arithmetic Asian options via the Edgeworth series expansion approach - ScienceDirect

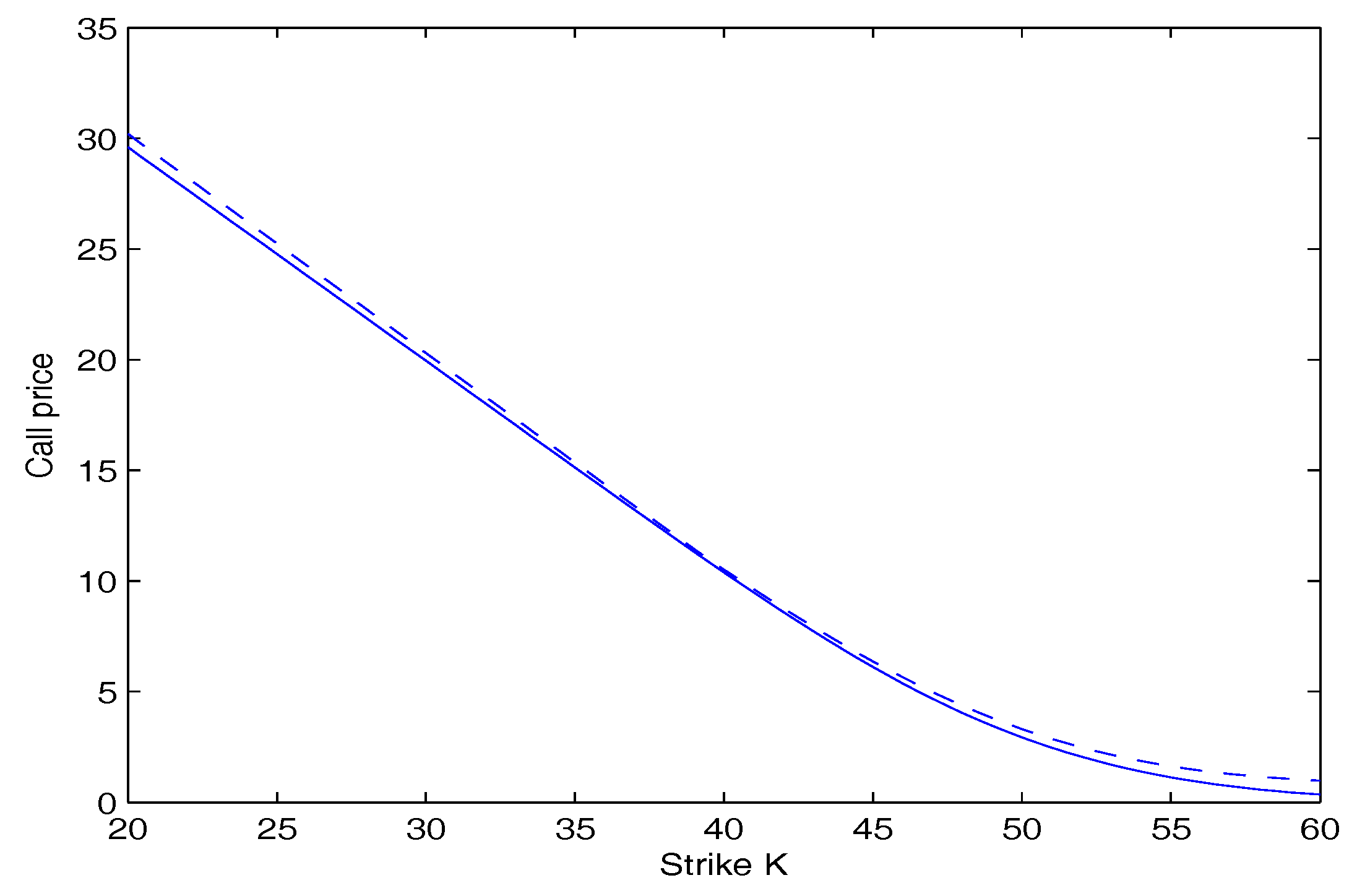

![PDF] MOST-LIKELY-PATH IN ASIAN OPTION PRICING UNDER LOCAL VOLATILITY MODELS | Semantic Scholar PDF] MOST-LIKELY-PATH IN ASIAN OPTION PRICING UNDER LOCAL VOLATILITY MODELS | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/1c01d49a40265e77e9536560bc1bd555b61f44e4/26-Figure4.2-1.png)